Your credit score is one of the most important numbers when it comes to financial health. But how is it calculated? What factors matter the most? Credit score algorithms, like the ones used by FICO and VantageScore, are complex systems that evaluate your creditworthiness based on various factors. In this post, we’ll break down these algorithms, helping you understand what truly impacts your score.

The Major Credit Scoring Models

There are two main credit scoring models you’ll hear about most often: FICO and VantageScore.

- FICO Score: This is the most widely used score by lenders. FICO scores range from 300 to 850, with scores above 670 generally considered good.

- VantageScore: Similar to FICO, VantageScore also ranges from 300 to 850. While it’s not as universally used as FICO, it’s still a major player in the credit scoring world.

Both models evaluate similar credit factors, but there are some differences in how they weigh these factors.

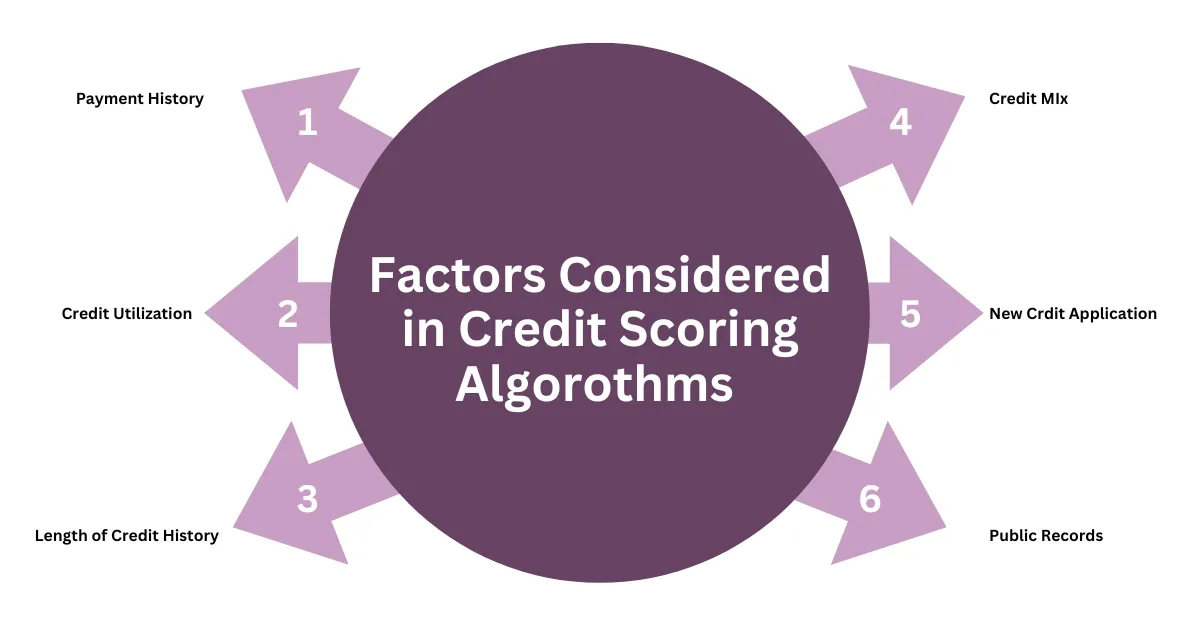

The 5 Key Factors Behind Your Credit Score

- Payment History (35% of FICO, 40% of VantageScore)

This is the most important factor in your credit score. Lenders want to know if you’ve been reliable in paying back what you owe. Late payments, collections, and charge-offs can severely impact your score.- What matters: Consistently paying bills on time. Even one missed payment can lead to a dip in your score.

- Pro tip: Set up automatic payments or reminders to avoid late payments.

- Credit Utilization (30% of FICO, 20% of VantageScore)

This refers to the percentage of your available credit that you’re using. A lower credit utilization ratio is better for your score because it shows that you’re not over-relying on credit.- What matters: Keeping your utilization below 30%, but for an optimal score, aim for 10% or less.

- Pro tip: If you have high balances, consider paying them down before your statement closes to reduce the reported utilization.

- Length of Credit History (15% of FICO, Moderate impact on VantageScore)

A longer credit history generally leads to a higher score. This factor looks at the age of your oldest account, the average age of your accounts, and how long it’s been since you last used certain accounts.- What matters: Keeping old accounts open even if you don’t use them regularly.

- Pro tip: Avoid closing old accounts, as this can shorten your average credit history and negatively impact your score.

- Credit Mix (10% of FICO, Moderate impact on VantageScore)

Having a variety of credit types—credit cards, mortgages, auto loans, etc.—can improve your score. It shows that you can handle different types of credit responsibly.- What matters: A healthy mix of revolving credit (e.g., credit cards) and installment loans (e.g., car loans, mortgages).

- Pro tip: Don’t take out loans just to improve your mix, but try to maintain a balance of credit types if possible.

- New Credit (10% of FICO, Moderate impact on VantageScore)

Every time you apply for credit, a hard inquiry is made on your report. Too many inquiries in a short period can lower your score.- What matters: Limiting the number of credit applications you make.

- Pro tip: Be strategic with credit inquiries, and if you’re shopping for a loan, do it within a short window (usually 14 to 45 days) to minimize the impact on your score.

The Differences Between FICO and VantageScore

Though FICO and VantageScore consider similar factors, they calculate your score slightly differently.

- FICO: Places a stronger emphasis on payment history and credit utilization.

- VantageScore: Weighs payment history even more heavily and puts less emphasis on the length of your credit history compared to FICO. VantageScore is also more forgiving of occasional late payments, especially if they aren’t recent.

Another key difference is how they treat new credit users. VantageScore requires only one month of credit history to generate a score, while FICO typically needs six months.

What Really Matters in the End?

Ultimately, what matters most across both scoring models is:

- Paying on time: Your payment history holds the most weight.

- Keeping balances low: High credit utilization is a quick way to hurt your score.

- Building a long, diverse credit history: Time and variety matter, but they’re secondary to paying on time and keeping debt in check.

By understanding these key factors and focusing on what matters most, you can build a strong credit score over time.

Final Thoughts

Credit scores may seem like a mystery, but they’re based on predictable patterns of financial behavior. By staying on top of your payments, managing your debt wisely, and being strategic about your credit applications, you can improve your score and gain better access to financial opportunities.

Remember, building and maintaining good credit is a long-term process, but with the right strategies, you can navigate the credit score algorithms to your advantage.