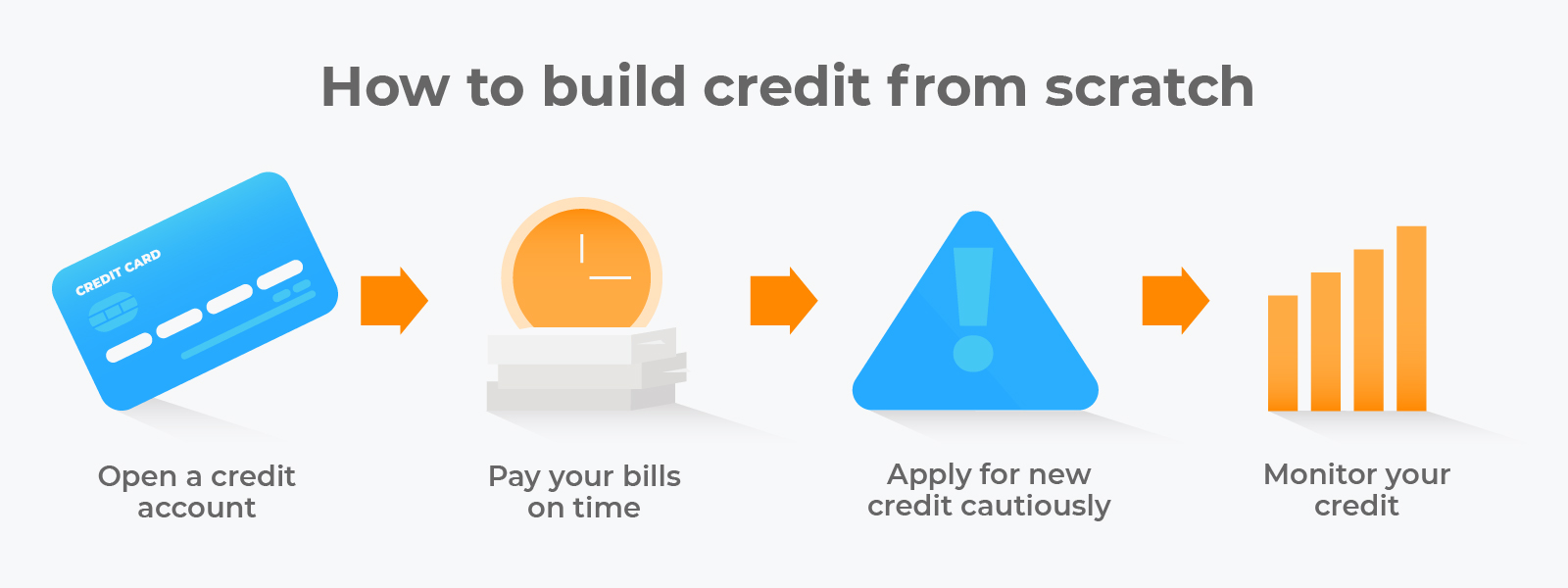

Starting your financial journey can be daunting, especially when it comes to building credit. Your credit score is crucial for obtaining loans, securing favorable interest rates, and even renting an apartment. For young adults and beginners, building credit from scratch requires careful planning and responsible financial habits. Here’s a guide to help you get started on the right foot.

1. Understand the Basics of Credit

Before diving into building credit, it’s essential to understand what credit is and how it works. Your credit score is a numerical representation of your creditworthiness, based on your credit history. The most common scoring model, FICO, ranges from 300 to 850, with higher scores indicating better credit.

2. Start with a Secured Credit Card

A secured credit card is an excellent option for beginners. It requires a cash deposit that serves as your credit limit. By using the card responsibly and paying your balance in full each month, you can establish a positive credit history. Over time, this can help you qualify for an unsecured credit card with better terms.

3. Become an Authorized User

Another way to build credit is by becoming an authorized user on a family member’s or friend’s credit card account. As an authorized user, you can benefit from their positive credit history, provided the primary account holder maintains good credit habits. Ensure the credit card issuer reports authorized user activity to the credit bureaus.

4. Apply for a Student Credit Card

Many banks and credit card companies offer student credit cards designed for young adults with limited or no credit history. These cards often come with lower credit limits and may have additional perks like cashback rewards or lower interest rates. Remember to use the card responsibly and pay off the balance each month.

5. Make On-Time Payments

Payment history is the most significant factor in your credit score, accounting for 35% of your FICO score. Always make your payments on time, whether it’s a credit card bill, student loan, or utility bill. Setting up automatic payments or reminders can help you stay on track.

6. Keep Your Credit Utilization Low

Credit utilization, the ratio of your credit card balances to your credit limits, is another critical factor in your credit score. Aim to keep your credit utilization below 30%. For example, if you have a credit limit of $1,000, try to keep your balance below $300. Paying off your balance in full each month is the best way to manage credit utilization.

7. Monitor Your Credit Report

Regularly checking your credit report helps you track your progress and identify any errors or fraudulent activity. You can request a free credit report from each of the three major credit bureaus—Experian, Equifax, and TransUnion—once a year through AnnualCreditReport.com. Consider using a credit monitoring service for more frequent updates.

8. Build a Diverse Credit Mix

Having a variety of credit accounts, such as credit cards, installment loans, and retail accounts, can positively impact your credit score. However, only take on credit you can manage and avoid opening too many accounts at once.

9. Limit Hard Inquiries

When you apply for new credit, lenders perform a hard inquiry on your credit report, which can temporarily lower your score. Try to limit the number of hard inquiries by applying for credit only when necessary. Note that checking your own credit report results in a soft inquiry, which does not affect your score.

10. Be Patient and Persistent

Building credit takes time and consistent effort. Focus on maintaining good financial habits, such as paying bills on time, keeping credit utilization low, and avoiding unnecessary debt. Over time, these practices will help you build a solid credit foundation.

Conclusion

Building credit from scratch is a crucial step toward financial independence and stability. By understanding the basics of credit, using credit responsibly, and monitoring your progress, you can establish a strong credit history. Remember, patience and persistence are key—stick to these tips, and you’ll be on your way to a healthy credit score in no time.

For more financial tips and resources, follow our blog and stay informed on the best practices for managing your finances.