In today’s fast-paced world, managing finances has become a crucial skill for individuals striving to achieve financial freedom. One common hurdle on the road to financial well-being is the burden of high-interest debt. However, there’s a powerful tool that savvy consumers use to ease this burden – balance transfers. In this blog post, we’ll explore the art of balance transfer mastery and how it can be your key to paying off debt smartly.

Understanding Balance Transfers:

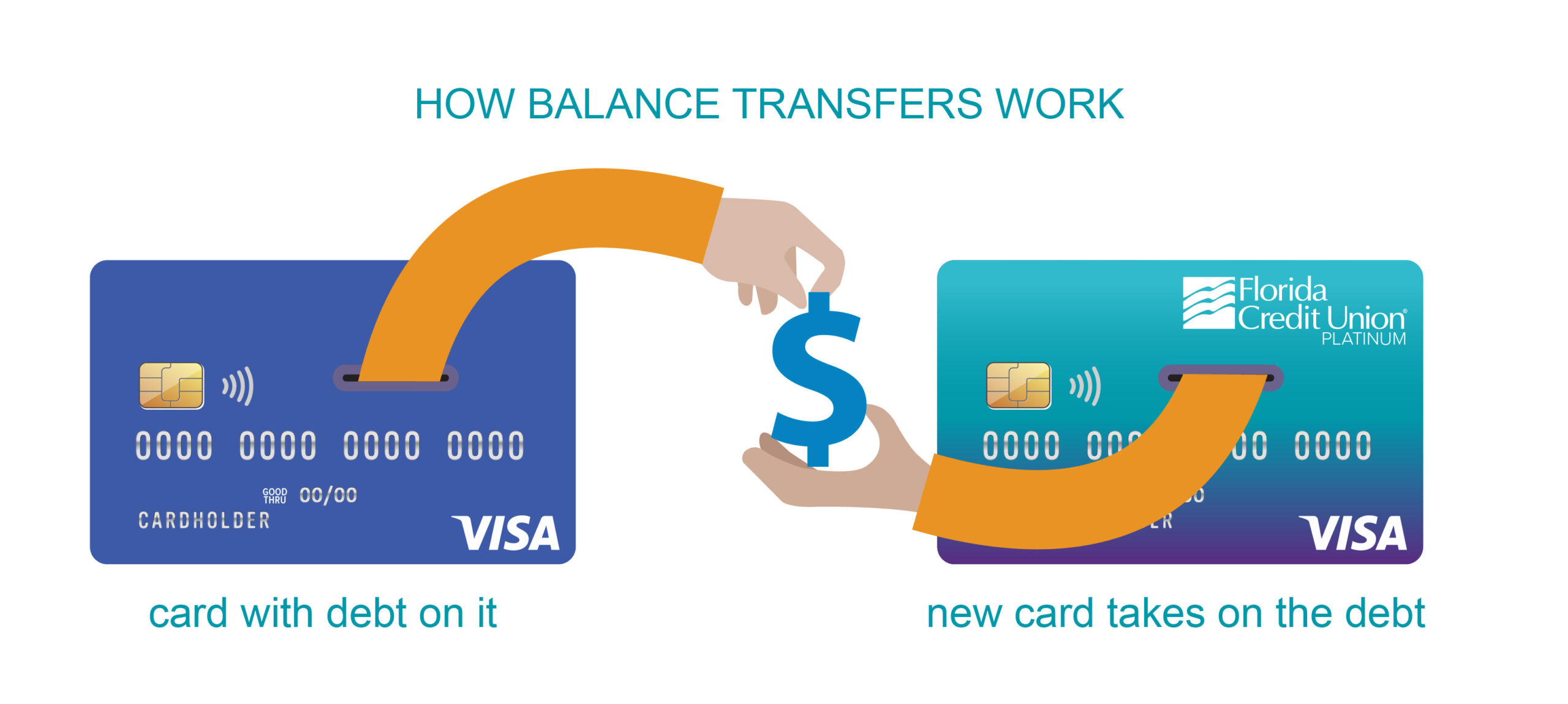

A balance transfer involves moving the outstanding balance from one credit card to another, often with a lower interest rate or an introductory 0% APR (Annual Percentage Rate). This strategic maneuver can save you money on interest payments and expedite your journey to becoming debt-free.

Choosing the Right Balance Transfer Card:

To become a master of balance transfers, the first step is choosing the right credit card for the job. Look for cards with low or 0% introductory APR periods, as this will give you a grace period to tackle your debt without accumulating additional interest. Additionally, consider balance transfer fees, annual fees, and the card’s long-term interest rates after the introductory period expires.

Crafting a Debt Repayment Plan:

Once you’ve selected the ideal balance transfer card, it’s time to craft a debt repayment plan. Calculate the total amount you owe, set a realistic timeline for repayment, and determine the monthly payments needed to achieve your goal. Remember to account for the introductory period, as well as any fees associated with the balance transfer.

Avoiding Common Pitfalls:

While balance transfers can be a powerful debt-reduction tool, it’s crucial to avoid common pitfalls that could hinder your progress. Be wary of missing payments, as this may result in the loss of your introductory APR or other penalties. Additionally, refrain from using the newly emptied credit card for new purchases, as this can counteract your debt reduction efforts.

Monitoring Your Progress:

Regularly monitoring your progress is an essential aspect of balance transfer mastery. Keep a close eye on your credit card statements, track your debt reduction, and adjust your plan as needed. Celebrate milestones along the way to stay motivated and focused on your financial goals.

Exploring Alternative Strategies:

While balance transfers are effective, they may not be suitable for everyone. Explore alternative debt repayment strategies, such as the debt snowball or debt avalanche methods, to find the approach that aligns best with your financial situation and goals.

Conclusion:

Balance transfer mastery is a valuable skill for those seeking to pay off debt smartly and efficiently. By carefully choosing the right balance transfer card, creating a realistic repayment plan, avoiding common pitfalls, and monitoring your progress, you can take control of your finances and work towards a debt-free future. Remember, the journey to financial freedom begins with a strategic and informed approach to managing your debts.