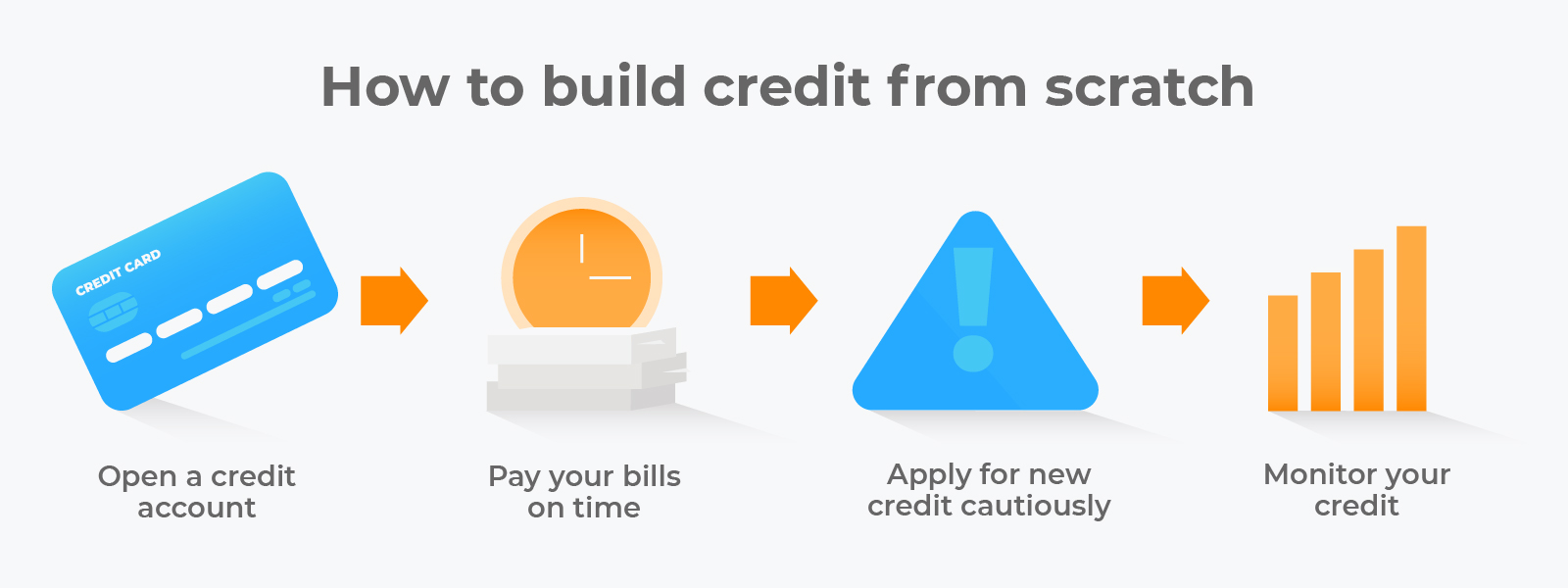

Embarking on the journey of building credit for the first time can be both exciting and a bit daunting. Establishing a strong credit history is a crucial step toward financial independence, as it opens doors to various opportunities such as renting an apartment, obtaining a car loan, or even securing a mortgage. In this blog post, we’ll guide you through the essentials of building credit from scratch, demystifying the process and setting you on the path to financial success.

Understanding Credit Basics:

Before diving into the strategies for building credit, it’s essential to grasp the fundamentals. Credit is essentially a measure of your ability to borrow money and repay it on time. A credit report, maintained by credit bureaus like Equifax, Experian, and TransUnion, details your credit history, including information about loans, credit cards, and payment history.

- Start with a Secure Credit Card:

For those new to credit, a secure credit card can be a fantastic starting point. Unlike traditional credit cards, secure cards require a cash deposit as collateral, minimizing the risk for lenders. By using a secure credit card responsibly—making timely payments and keeping your balance low—you’ll begin to establish a positive credit history.

- Become an Authorized User:

If you have a family member or close friend with a solid credit history, consider becoming an authorized user on their credit card. This allows you to piggyback on their positive credit activity, boosting your own credit score. However, it’s crucial to choose a responsible and trustworthy person for this arrangement.

- Explore Credit-Builder Loans:

Credit-builder loans are specifically designed to help individuals build credit. These loans work by depositing a small amount of money into a locked savings account, and as you make monthly payments, your payment history is reported to the credit bureaus. Once the loan term is complete, you receive the saved funds, and you’ve built credit in the process.

- Stay Current on Bills:

While credit cards and loans are primary vehicles for building credit, don’t overlook the impact of paying bills on time. Timely payments for utilities, rent, and other regular expenses can positively contribute to your credit history.

- Monitor Your Credit Report:

Regularly check your credit report for accuracy and potential errors. You are entitled to one free credit report from each of the major credit bureaus annually. Reviewing your report allows you to address any discrepancies promptly and ensure your credit history is a true reflection of your financial behavior.

Building credit for the first time is a gradual process that requires patience and responsible financial habits. By starting with a secure credit card, exploring credit-builder loans, and maintaining a consistent record of on-time payments, you’ll pave the way for a strong credit foundation. Remember, building credit is a journey, not a sprint. Stay informed, make wise financial decisions, and watch your credit score flourish, opening doors to a brighter financial future.