Understanding the various factors that impact your credit score can seem like a complicated puzzle. But, one piece that holds substantial weight is your credit utilization rate. In this blog post, we’ll shed light on what credit utilization is, how it influences your credit score, and ways to improve it.

Understanding Credit Utilization

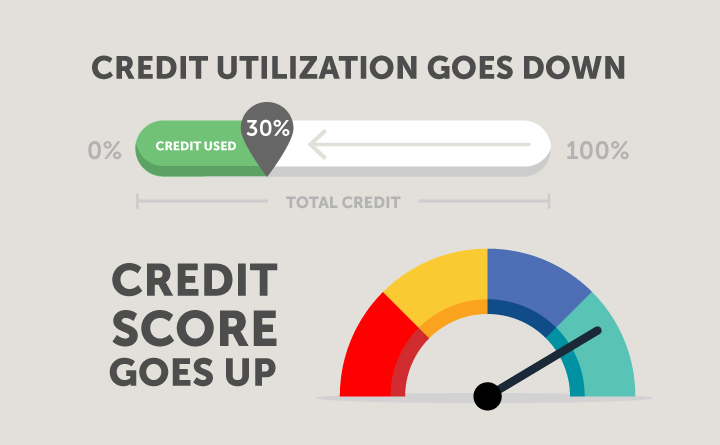

Credit utilization, or the ratio of your credit card balances to your total credit limit, is a significant factor in calculating your credit score. It accounts for nearly 30% of your FICO Score, a commonly used credit scoring model. The lower your credit utilization rate, the better it is for your credit score.

How Credit Utilization Affects Your Credit Score

A high credit utilization rate may signal to lenders that you’re over-reliant on credit, which can negatively impact your credit score. Ideally, experts recommend keeping your credit utilization rate below 30%. This shows lenders that you’re using credit responsibly and not maxing out your available credit.

Improving Your Credit Utilization Rate

1. Pay Off Balances Regularly: One of the simplest ways to lower your credit utilization rate is by paying off your credit card balances more frequently. Rather than waiting for the monthly statement, consider making bi-monthly payments.

2. Increase Your Credit Limit: Another strategy is to increase your credit limit. However, this isn’t a free pass to accumulate more debt. Instead, it provides a buffer to lower your credit utilization rate.

3. Use a Personal Loan: If you have high credit card debt, you could consider a personal loan. The loan can help pay off the debt, and since it’s an installment loan, it’s not included in the credit utilization calculation.

Understanding and managing your credit utilization can play a significant role in improving your credit score. By consciously maintaining a lower credit utilization rate, you demonstrate responsible credit behavior that can lead to a healthier credit profile. Start monitoring your credit utilization today and take one step closer to better financial health.